No matter the size of your business, outsourcing your payroll system can improve your one-upmanship, by maximizing valuable time and sources that can be spent on boosting the top quality of the service or product you supply. Sayings gain the wisdom with which they are associated by confirming real time as well as again, and there is no sage recommendations truer than this-- you need to invest cash to earn money. Investing in a pay-roll service places most of your Human Resources and also monetary needs in the hands of the professionals, enabling you commit your full attention to broadening your very own expertise in your picked area.

Payroll solutions take a substantial section of the day-to-day administration of your business and place it in specialist hands. Outsourcing this vital task makes certain the prompt as well as exact settlement of your retinue of team, which eventually brings about the growth of the goodwill of what is potentially any business's essential resource. A pleased work force produces an reliable company, and also with your pay-roll system in the hands of a firm dedicated to the job, you can be certain that your work force will obtain the economic focus they should have to help them stay inspired.

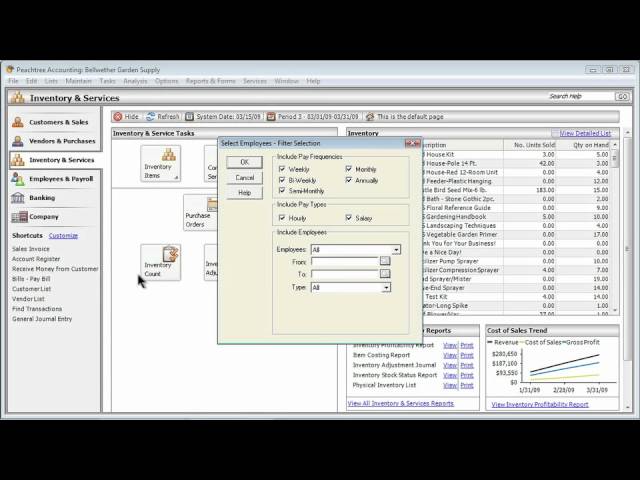

Administering a pay-roll system can be a time consuming event; the procedure entails not just the payment of personnel but likewise taking care of questions and queries, problems with tax and also any kind of other issues that might develop. Managing such issues, while an crucial part in great staff management, can be lengthy, taking away focus from the extra creative areas of a company's day-to-day jobs. Pay-roll services use a veterans canteen services payroll deduction business the flexibility to concentrate on what it is they do best, while ensuring that the staff that make it happen are made up in a timely fashion for the work they include in the table.

Lots of pay-roll business provide a variety of other solutions also, from various other Human Resources services to reporting, assisting you invest a lot more time on cultivating the services or product your company uses. There are likewise a series of speciality pay-roll solution firms, so make sure to pick the one most very closely affiliated with your business's industry. Certain sorts of service will certainly have certain payroll needs; the friendliness market, for instance, requires the correct management of tips. For the best benefit to your business, be sure to choose a payroll solution expert that can adjust themselves to the needs of your business.

Improve your organisation by outsourcing your pay-roll management to a expert company, and dedicate your valuable time to what it is your business does best.