Specifically if you happen to be among those unflinchingly ambitious micro-business entrepreneurs, I've been reading concerning day-to-day in bars like Crain's Chicago Service, you'll eventually locate that creating and providing an attractive employee-benefits bundle will be an essential component of your future development. An attractive health plan will certainly do just that-- draw in-- helping you recruit as well as retain essential staff members ( implying those fought over creative class/knowledge employee kinds Richard Florida is constantly yammering concerning). You'll additionally discover that a generous group plan will certainly aid link your employees' rate of interests to your problem's.

That said, there are a apparently endless variety of group advantages alternatives to think about. One that you'll intend to transfer to the top of your checklist is a Cafeteria Plan. The snack bar brand of benefit plan can add a whole lot flexibility to a staff member compensation package, allowing your workforce to choose advantages options ala carte, if you will certainly-- selecting just the advantage options they're most thinking about.

Possibly I should begin closer to the start ... cafeteria plans, additionally referred to as the flexible investing account, the selection spending account or the section 125 plan, have actually become increasingly preferred over the last few years because they're made to provide employees a genuinely convenient method to pay clinical expenses with pre-tax dollars; easing them of the worry of federal, and state taxes.

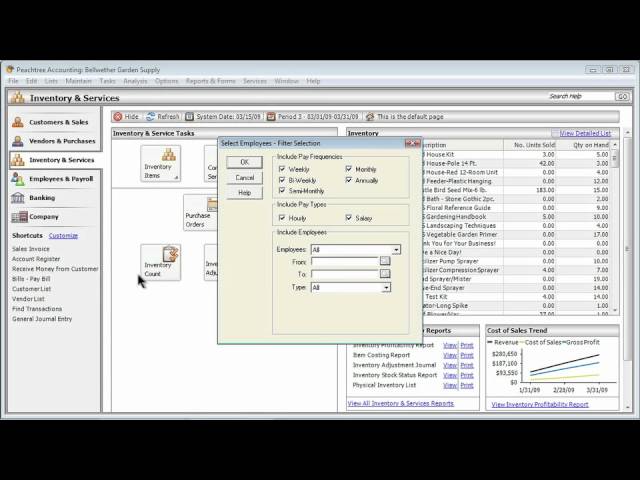

To benefit from a versatile spending account, qualified employees alloted a pre-designated amount each year, in order to pay for clinical expenditures aren't currently eligible for coverage. The two most common types of flexible-spending accounts rest care repayment ( additionally called DCRAs) as well as healthcare repayment accounts. Employees pay for non-reimbursed expenditures from these accounts. Unfortunately, flexible-spending accounts are "use-it-or-lose-it" accounts; implying that any kind of funds remaining at the end of the year can't be " surrendered," so to speak.

Exceptions To Those Limits Put On Secret Employees

Normally, funds allot in a cafeteria plan's flexible-spending account are exempt from income, payroll, and also joblessness taxes. This exemption usually also puts on payroll and also unemployment taxes paid on behalf of staff members. (Take a look at Internal Revenue Service Club. 15-B for exemptions, corporate payroll service consisting of treatment of very compensated employees as well as certain shareholders of Subchapter S Firm's.).

Premiums paid to a team life benefits plan are typically exempt from income and also unemployment taxes. Additionally, premiums spent for approximately $50,000.00 of advantages insurance coverage per worker often tend to be exempt from pay-roll tax obligations. For added details, see Internal Revenue Service Magazine 15-B.

You see, cafeteria plans supply you some flexibility in putting together a advantages plan for your workforce. There are various other groups of fringe benefits that you can provide your staff members in a cafeteria plan that might be left out from gross income under IRS benefit-exclusion guidelines. Using a flexible-spending account-- specifically, developing a DCRA and HCRA-- may aid to jump-start a cafeteria plan for your workforce. If you preserve a cafeteria plan, the IRS needs you to finish IRS Kind 5500.

To help you monitor employment-related expenses, the U.S. Bureau of Labor Statistics (BLS) publishes a quarterly fact called the work cost index. The expense index measures modifications in employee-compensation expenses, that include incomes, wages, and also benefits. Along with releasing the quarterly expense index, BLS releases an annual study of settlement costs.

One last thing ... the information over is almost for home entertainment functions as well as should not be taken economic guidance. For suggestions certain to your company's scenarios, do not wait obtain guidance from a economic, tax obligation or advantages expert. You might even intend to all out employ an Interim advantages consultant or a complete advantages getting in touch with firm. There are also a number of great sources of details on the internet you can make the most of. The Staff Member Perk Study Institute (EBRI), International Foundation of Employee Benefit Plans (IFEBP), and American Conveniences Council are independent resources of really "actionable" employee-benefit strategy info.